The Problem: Not Everyone Wants to Log Into Their Bank

For years, we’ve made it easy for consumers to pay using their bank accounts instead of a credit or debit card. This is especially common for larger purchases or recurring payments like subscriptions, memberships, and invoices.

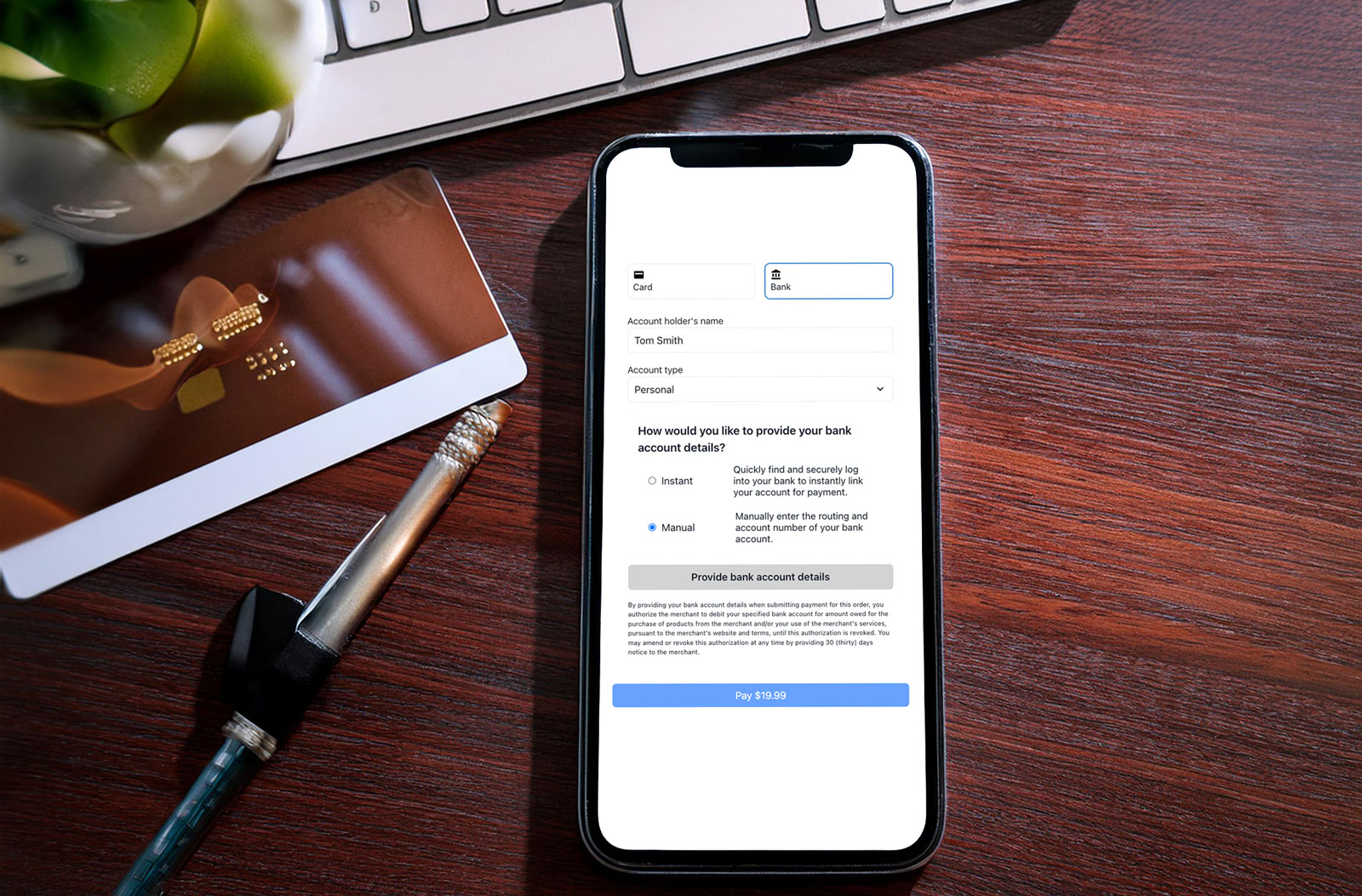

Our system would let customers log into their bank to authorize payments—no need to manually enter complicated routing or account numbers. But while this was a great experience for many, some users preferred the old-school method: manually typing in their bank details. Our clients needed a way to support both options.

The Solution: Secure, Manual Bank Entry for ACH Payments

Now, our Elements embeddable payment widget gives software platforms the flexibility to accept ACH payments in two ways:

- Bank Login – A seamless experience for those who prefer to connect their accounts digitally.

- Manual Entry – A traditional option for users who know their routing and account numbers and want to enter them directly.

On the surface, it seems simple. But behind the scenes, we ensure compliance with NACHA regulations, validate accounts, and run fraud checks—all in real time—to protect businesses from risk.

The Impact: A Better Payment Experience for Businesses and Their Customers

In B2B payments, many users don’t have quick access to their online banking credentials, but are familiar with entering their routing and account numbers. This feature makes ACH payments more accessible, removing friction while maintaining security.

For software platforms, that means more completed payments, happier customers, and the ability to monetize ACH transactions just like credit and debit payments. More options, fewer headaches, and a better payment experience for everyone.