The Problem: Confusing Sales and Bank Data

One of the biggest frustrations for businesses accepting payments is making sense of their sales data compared to what (and when) actually hits their bank account. It sounds simple, but it’s not.

Payouts aren’t just a straightforward deposit of daily sales. They include a mix of transactions—some positive, like approved sales, and some negative, like chargebacks from weeks or months ago. This jumble of numbers leads to confusion and a flood of support tickets from merchants trying to figure out why their numbers don’t match.

The Solution: Transparent, Accurate Reconciliation

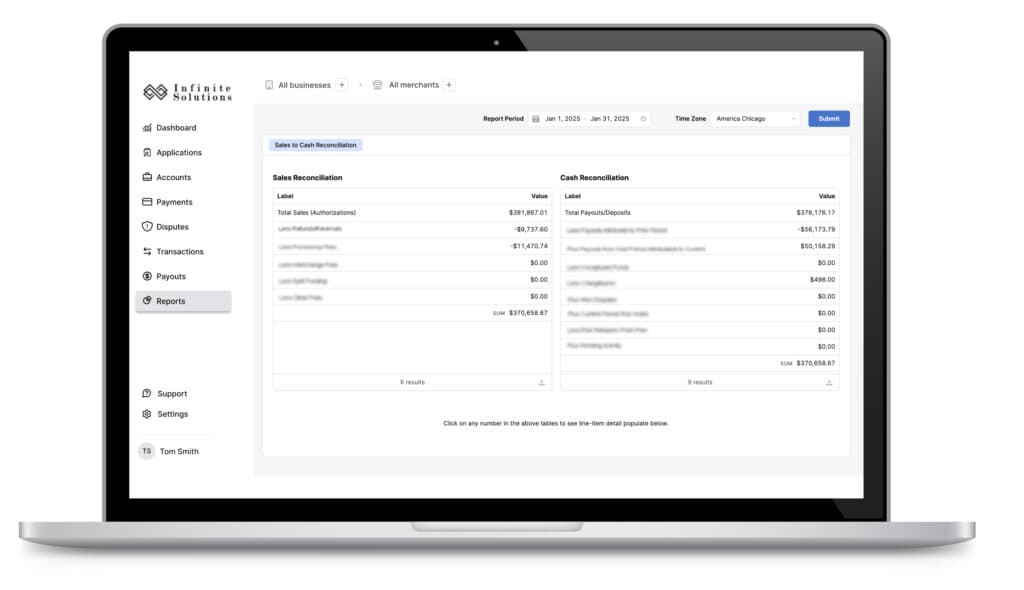

Our new feature gives businesses a crystal-clear view of their payouts. They can select any time period, across any time zone, and instantly see how their sales activity aligns with their bank deposits. Every transaction is tracked, matched to the penny, and easy to sort, search, filter, and download.

The result? Hours of manual work are eliminated, and software companies are fielding far fewer support calls.

The Impact: Better Accuracy, Fewer Headaches

What really shocked us was discovering that many well-known payment platforms—big, publicly traded ones—don’t reconcile to the penny. That means businesses relying on them are left guessing when their numbers don’t line up.

We built this tool to fix that problem. It ensures software platforms can provide reliable, accurate reconciliation for their merchants, reducing support costs and protecting their brand reputation.

For businesses processing payments, transparency and accuracy matter. With this feature, we’re making sure every dollar is accounted for—down to the last cent.