Running a payments business is hard. Building a payments business inside of a software company is really hard. But it doesn’t have to be.

At Forward, we talk to hundreds of companies looking to learn more about building out their payments vertical. Due to a number of challenges that we’ll dive into here, most of them have achieved less than 20% of their potential.

Today’s focus will be on supporting your customers’ payments needs after they’re up and running. An important thing to note is that customers rarely churn from their payments software provider due to the cost, but rather because:

-

- They can not reconcile

-

- Funds are not settled in a timely manner

By solving each of these pain points proactively, Forward clients enjoy far fewer support inquiries from their customers.

Solving Merchant Reconciliation with Precision

But how do we do this? To solve merchant reconciliation, we built an interactive tool that allows merchants to view any day, week, month, quarter or year and reconcile the sales they made using the software with the bank deposits they received. This is harder than it sounds, and shockingly, many that are at scale (think billions in payment volume) fail in this department. The reason we can reconcile to the penny is because we made a series of technical and architectural decisions to set us up for this based on our decades of experience in the SaaS industry. This includes investing in our own ledger and sub-ledgering every customer account at our bank.

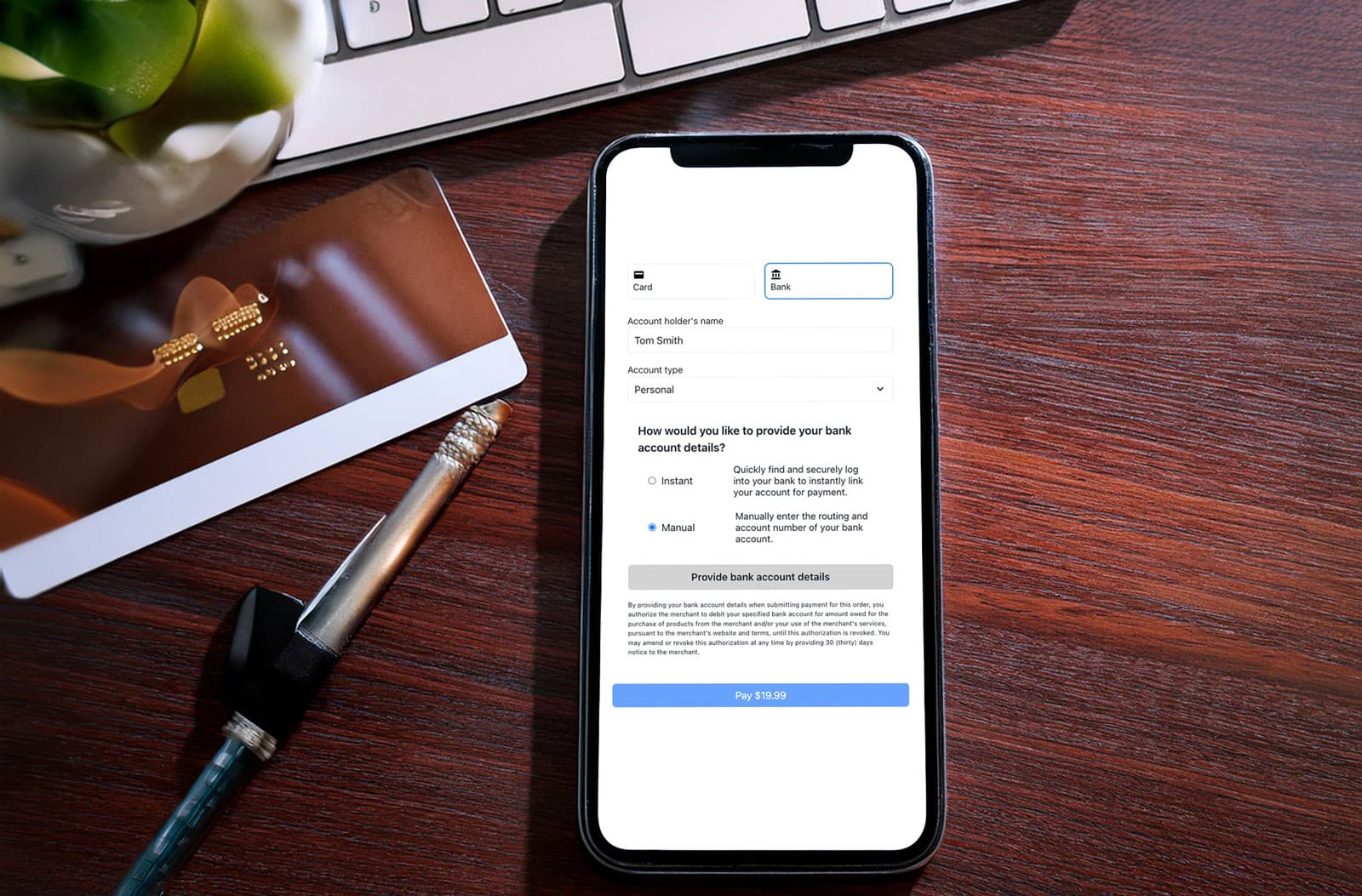

Transparency at Every Step of the Payments Journey

We then built a tool to help merchants understand the ins and outs of payments including fees, refunds, chargebacks, risk holds and releases, and all other payment states. Finally, every authorization ties to a settlement, allowing the customer to drill down into their payouts through a number of helpful lenses. If an accountant is off by even a few pennies, their job is not done. They’ll have to resolve the discrepancy, which doesn’t exist with Forward.

To solve timely funds settlement, Forward deposits funds to customers as fast as any processor in the industry. Unfortunately, there are times when a portion of a settlement must be held for further investigation. For example, a $10,000 transaction when the merchant typically processes sales of $100. But in these instances, we prioritize communication and provide an immediate notification to the merchant that a transaction has been held, why it was held, and what additional information we need to release the funds. When they submit support for the transaction, it is immediately ingested by our risk engine and actioned for release. This cuts the time funds are held from weeks to minutes.

Whether you have 500, 5,000, or 15,000 customers relying on your payment solution, they will require support. Your platform will either empower you to provide that support seamlessly—or it will drown you in hundreds or thousands of calls per week.

At Forward, we chose the former. Our platform was built with tools and technology designed to minimize friction for both you and your customers. Because when your customers have the right tools, they don’t need to reach out as often. And when they do, they get answers fast.

So if you’re ready to support your customers’ payment needs with precision, transparency, and speed, Forward is here to make it happen. We’ve done the hard work so you don’t have to—so you can focus on what matters most: growing your business.