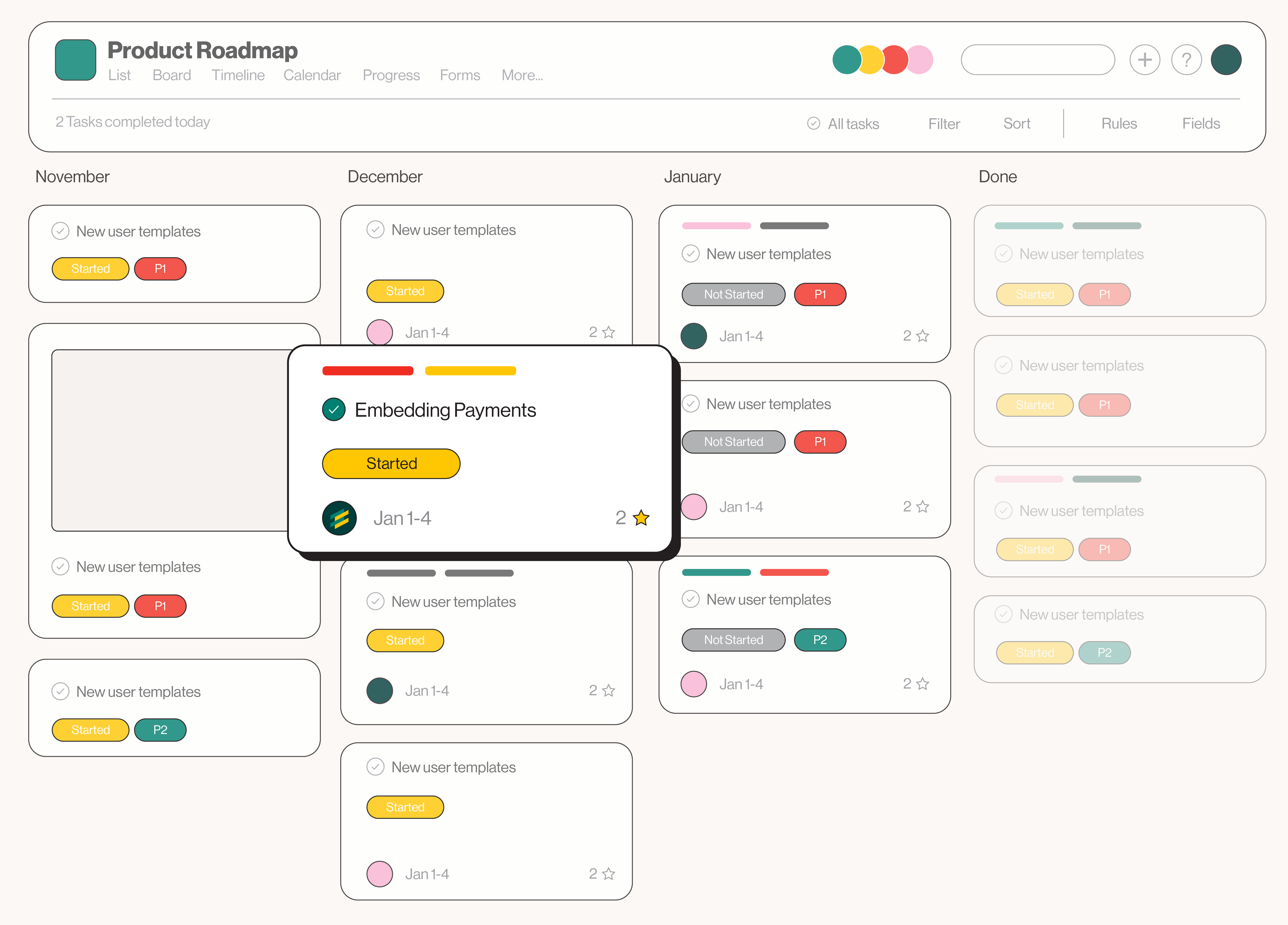

Every business is looking for that next feature, or addition that’s going to move the needle.

But we know the one that has the potential to make the most financial impact: payments. We can help you embed the feature that may very well double your revenue.

This is called monetizing payments.

The fastest growing SaaS companies have at least one “indirect” source of revenue.

You acquired your customer, through hard work, but payment processors, banks and other middle-people are making money off your customers that you should keep.

Is the juice worth the squeeze?

Depending on the software you provide, embedding payments could be a true game changer. We offer a free (yes, for real) consultation to help you understand the opportunity size for your business. In most cases, payments revenue equals or exceeds your SaaS revenue.

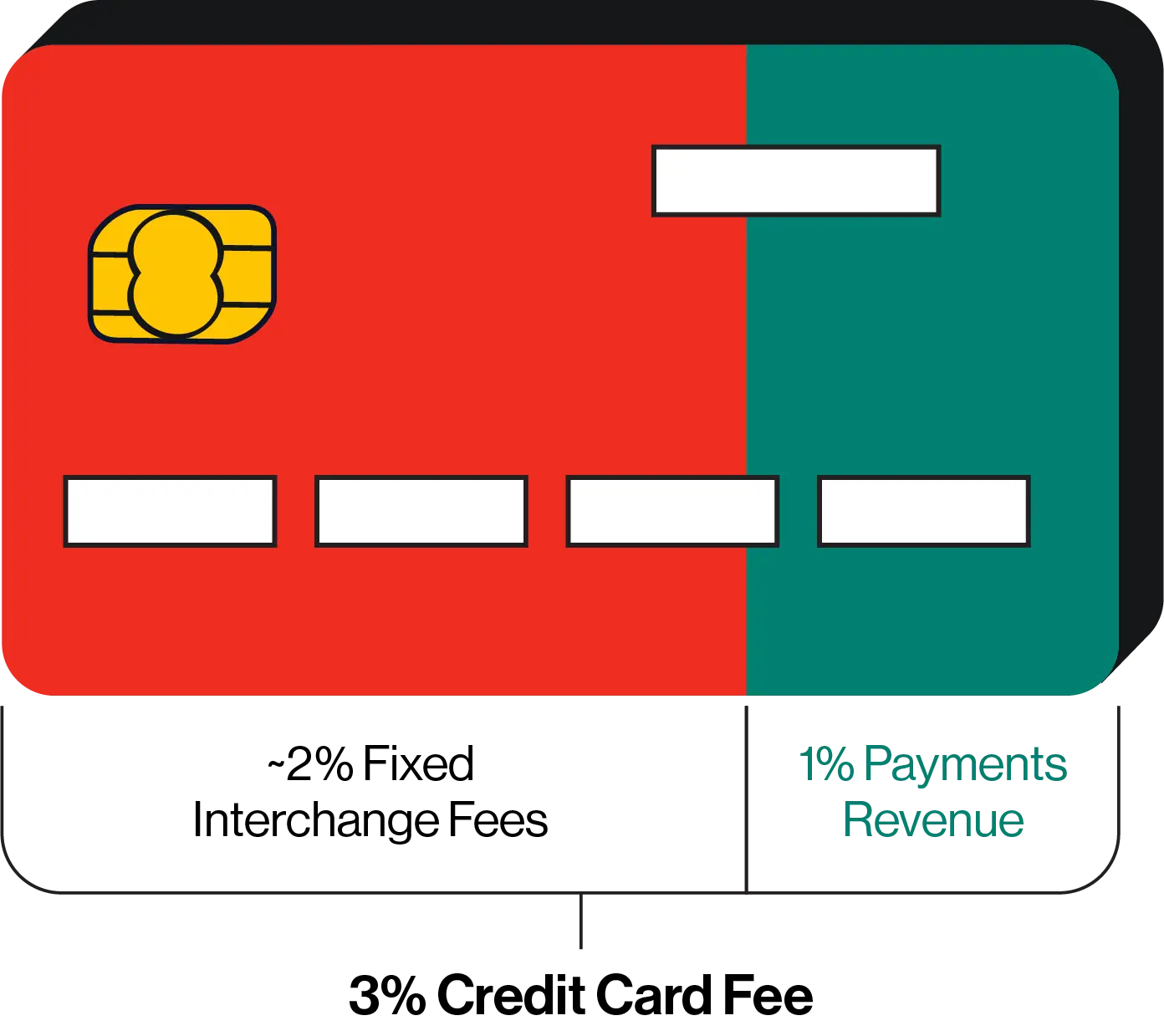

Reclaim up to 1/3 of credit card fees*

- 3%

- 2%

- 1%

- Small and medium businesses pay approximately 3% to accept credit cards

- The cost of payments is approximately 2% paid to the networks (Visa) and issuing banks.

- You should expect to make most of the 1% difference in new, high margin revenue

Double your Revenue*

Most SaaS firms find payments revenue equals or exceeds their current SaaS revenue.

Improve Customer Experience

Enable customers to receive, track, and manage payments inside your application.

Improve Customer Retention*

SaaS customers using payments are less likely to churn as you are tied to their revenue.

*Data on this page derived from advisory services